pay ohio unemployment taxes online

Office of Unemployment Insurance. A note about the documents included on this page.

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

The Department of Taxation issued the tax alert Ohio Income Tax Update.

. Unemployment benefits paid to eligible claimants are. E1 A small farm winery shall collect all sales taxes and excise taxes due on a sale to an individual of this state as if the sale took place on the premises of the small farm winery including without limitation taxes under 3-5-1605 3-7-104 3-7-111 and 3-7-201. Applying online is the quickest way to start receiving unemployment benefits.

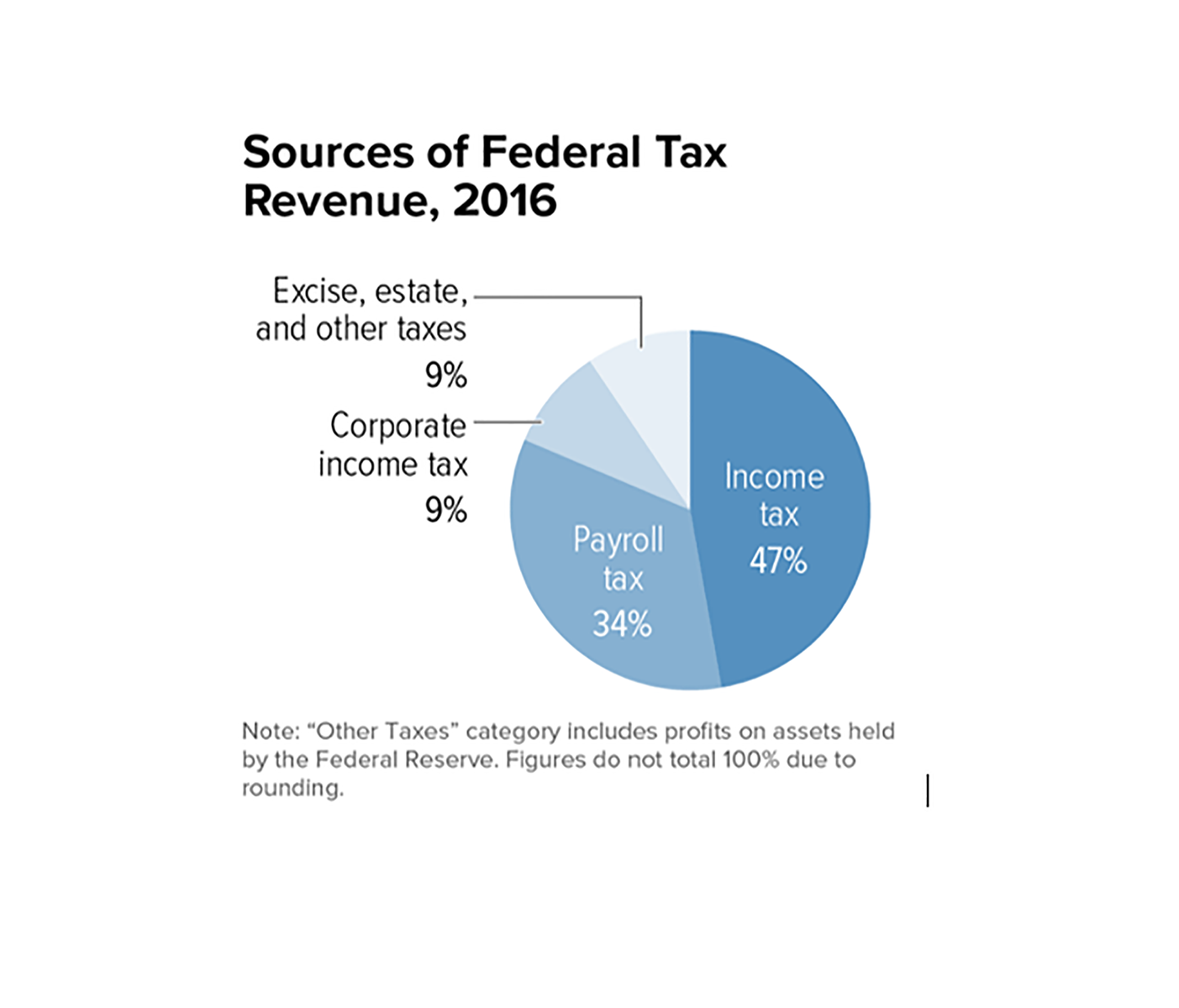

What kind of pay raise can US. In all 50 states employers pay the same 6 rate for each and every worker but the federal government may change the rate in future years. 1 Best Per Capita includes the population aged 18 and older.

Of course the taxes you pay in Ohio depend in part on where you live. 32312 manufactured homes ORC. File Unemployment Taxes Online.

Report it by calling toll-free. For business filing tax registration online services Ohio Business Gateway and more. Taxes on real estate are due in January and June of each year.

In general employers must pay 6 of gross wages up to a cap of 7000 per worker in order to fund federal unemployment taxes FUTA for each employee. Government Publishing Office Page 134 STAT. But you should still pay federal nanny taxes including FICA taxes and the federal unemployment tax Local Income Taxes.

House Bill 632 Chapter 352 Acts of 2011 the Earned Income Credit Information Act requires the Comptroller to publish the maximum eligibility for the State earned income tax credit EITC on or before January 1 of each calendar year. Real Estate Tax Information. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1.

E-file and e-pay together means there is one step to file your state forms and pay your state taxes. In accordance with the Ohio Revised Code the Hamilton County Treasurer is responsible for collecting three kinds of property taxes. Ohio Department of Job and Family Services PO.

You are NOT required to have an account with US Bank to submit an electronic check payment. Electronic check payments are processed via US Bank on behalf of the Treasury. Highlighted below are two important pieces of information to help you register your business and begin reporting.

Payments can be made via electronic check credit or debit card. 116th Congress Public Law 136 From the US. 450306 and personal property ORC.

Unemployment taxes paid are credited to an employers account. 281 Public Law 116-136 116th Congress An Act To amend the Internal Revenue Code of 1986 to repeal the excise tax on high cost employer-sponsored health coverage. Apply for Unemployment Now Employee 1099 Employee Employer.

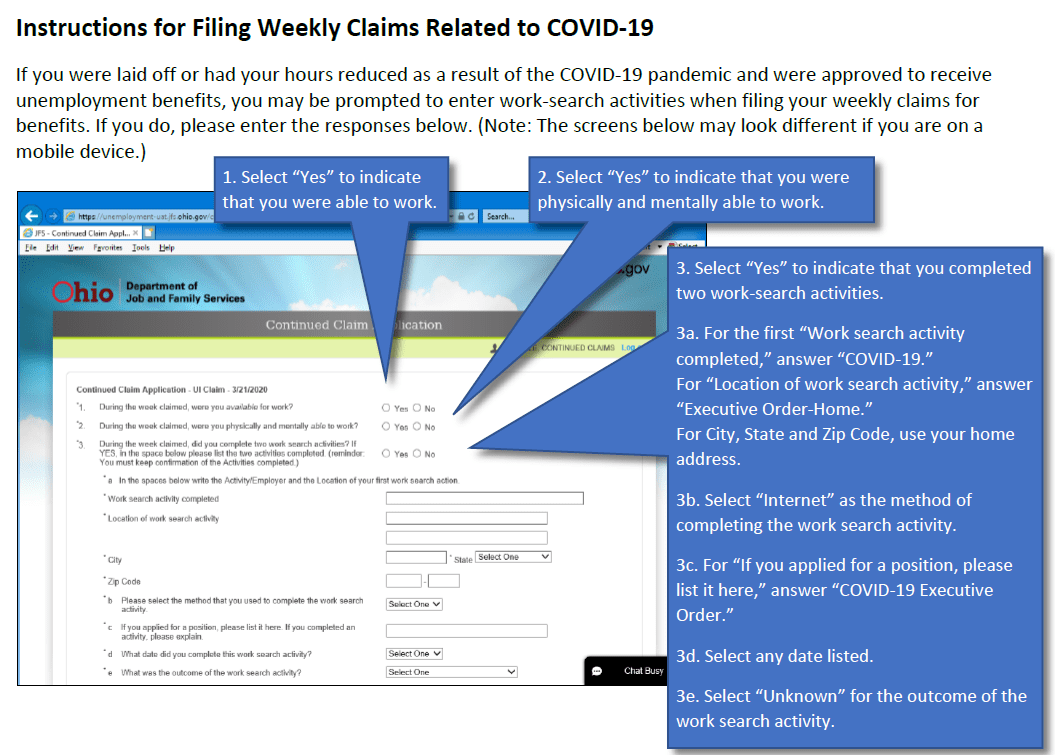

My claim is. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits related to COVID-19. Using this service you can search for your Cuyahoga County Ohio property tax bills and pay them online.

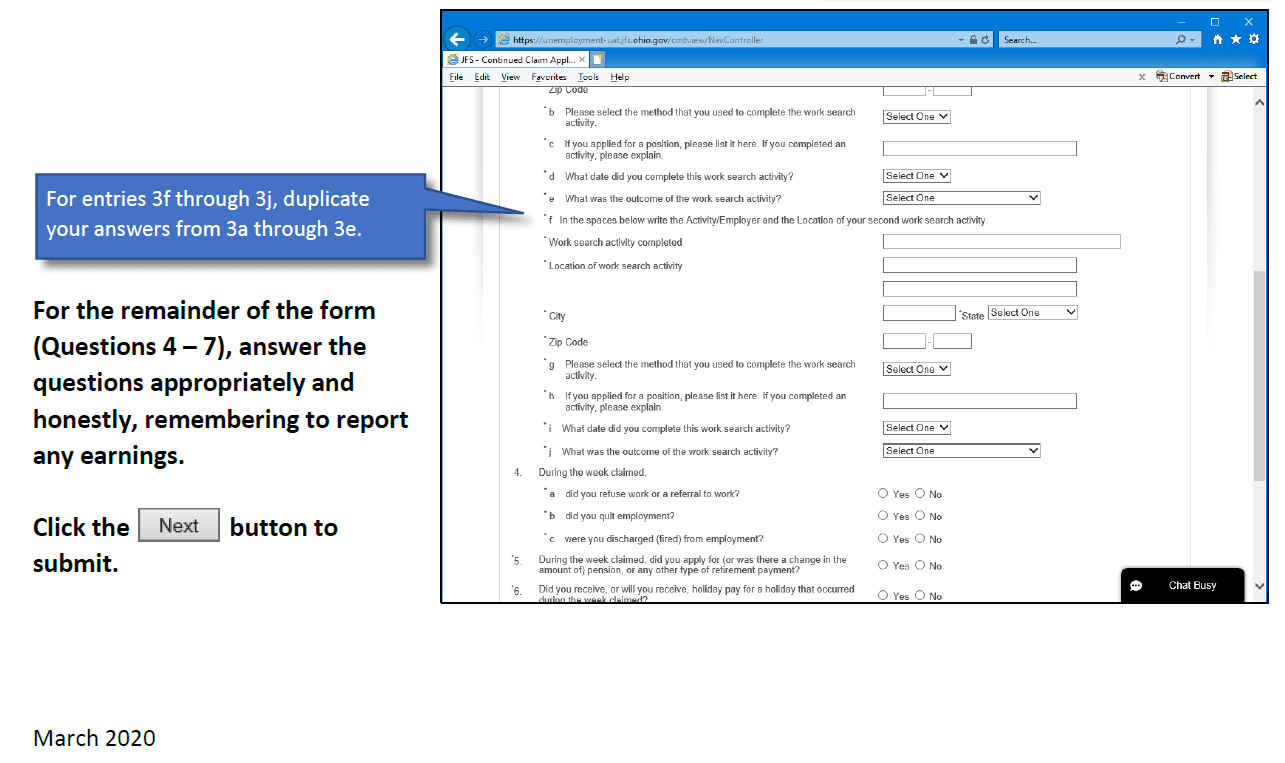

You can only make one e-payment per tax per liability periodIf you need to make more than one payment in the same liability period youll need to pay it manually directly to the state agency. Many states Connecticut Colorado Florida Illinois and Ohio to name a few have found they overpaid unemployment benefits during the past year. Some states have been sending letters to.

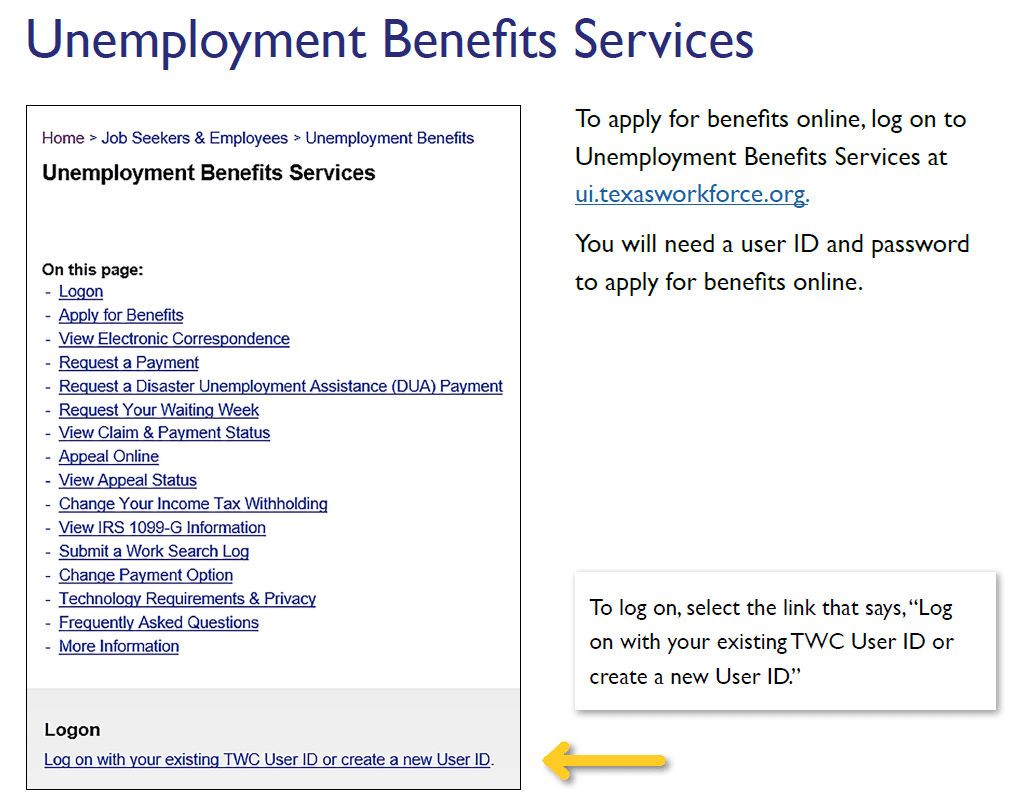

To apply online go to unemploymentohiogov. They are done at the same time. Please visit unemploymentohiogov click on the Report.

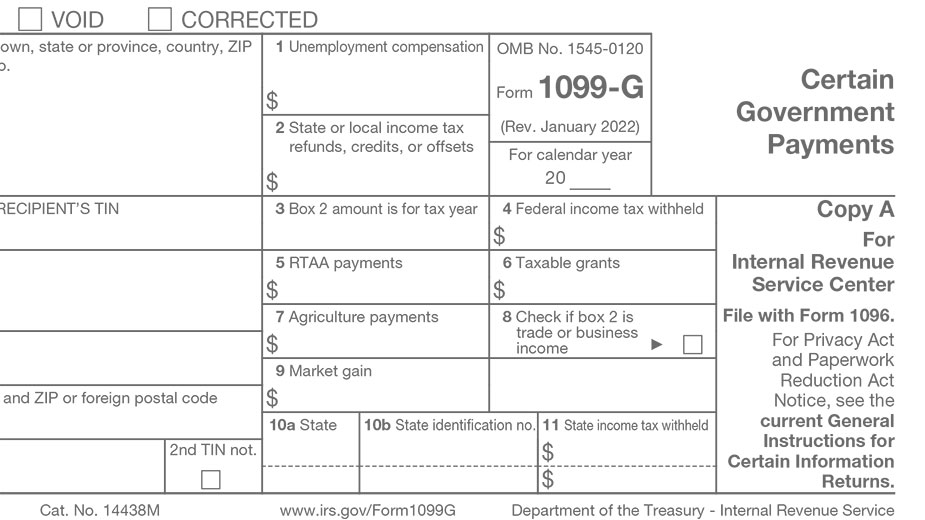

Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. Street Address Acceptable documents to prove your street address include a bank statement pay stub W-2 Wage and Tax Statement from the last complete tax year or 1099 form. If youre looking to buy a home in.

Box 182059 Columbus Ohio 43218-2059 If you have any questions or concerns about making a repayment please call 877-644-6562 option. Money that is contributed to an HSA account can be used to pay for out-of-pocket healthcare expenses. Resources for filing and paying business taxes online.

Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Dems propose raising taxes on high. 100 Milestone Documents from the National Archives a national initiative on American history civics and serviceThey were identified to help us think talk and teach about the rights and responsibilities of citizens in our.

Your contributions to an HSA are tax-deductible and when used for eligible expenses your. With the exception of Taxpayer ROI all of the columns in the table above depict the relative rank of that state where a rank of 1 represents the lowest total taxes paid per capita and the best government services respectively. And taxes on manufactured homes are due in.

Click here for a step-by-step guide to applying online. If you dont have access to a computer you can apply by phone by calling 877-644-6562. You will need this form to file your taxes.

2011 2012 2013 Lowest Experience Rate. Employers are offering heftier hikes but it still may not be enough to keep up with inflation. Again an example might help.

Workers expect in 2023. 1-877-OHIO-JOB to request a 1099 form. Home O hiogov Search Menu.

Weve developed a suite of premium Outlook features for people with advanced email and calendar needs. These documents were originally selected for the project Our Documents. Register file and pay business tax obligations.

Contribution Rates For 2011 2012 and 2013 the ranges of Ohio unemployment tax rates also know as contribution rates are as follows. This Act also requires the Comptroller to notify all employers in Maryland by mail of the information on the State EITC. Florida unemployment rate down to 27 percent Floridas unemployment rate dipped to 27 percent in July matching the level before the COVID-19 pandemic slammed into the economy in early 2020.

Changes in how Unemployment Benefits are taxed. Additional information about the Ohio Unemployment Tax can be obtained from our.

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

Respond To Employer Request For Separation Information Office Of Unemployment Insurance Operations Ohio Department Of Job And Family Services

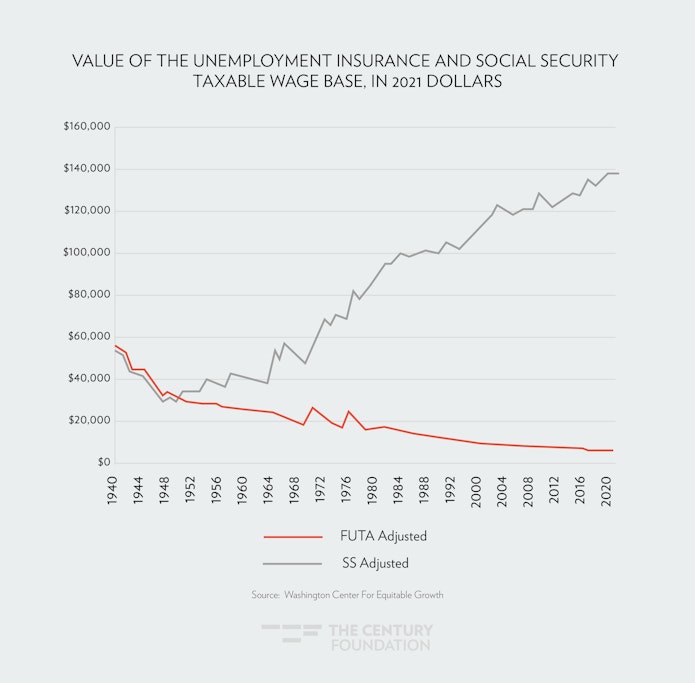

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

3 11 154 Unemployment Tax Returns Internal Revenue Service

Did You Receive Any Of These Documents Ohio Unemployment Benefits Help

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

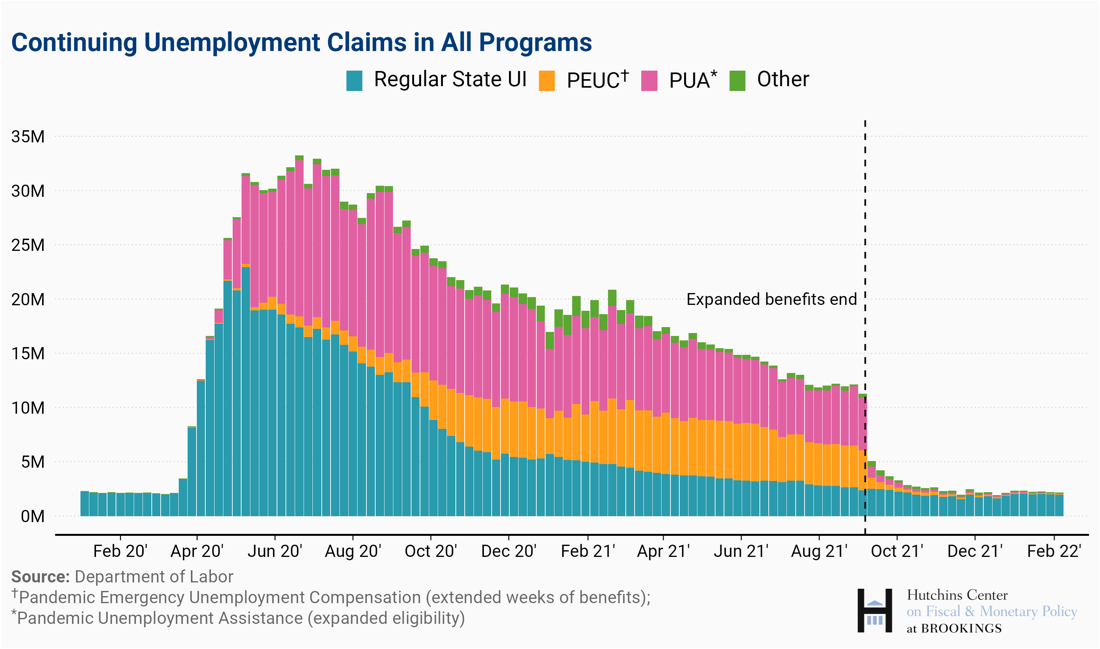

Covid 19 Unemployment Benefits Hamilton Ryker

Ohio Department Of Job And Family Services

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Ui Online Access Tax Information Form 1099g Using Ui Online Youtube

Covid 19 Unemployment Benefits Hamilton Ryker

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

How Does Unemployment Insurance Work And How Is It Changing During The Coronavirus Pandemic

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

2021 Instructions For Schedule H 2021 Internal Revenue Service